Car title loans feature biweekly payment schedules, offering a flexible and structured approach to repayment. This method benefits borrowers by dividing larger sums into smaller installments, aligning with pay cycles, and avoiding late fees. Strategic scheduling includes gradual interest accrual, improved loan terms, and variable rate reductions for timely payments. Pre-loan vehicle inspections ensure accurate collateral assessments, safeguarding borrowers from unexpected repair costs.

In today’s financial landscape, car title loans offer a unique opportunity for borrowers seeking quick cash. Understanding the structure of these loans is key, especially when exploring payment options like biweekly schedules. This article delves into the intricacies of car title loan structures and highlights the advantages of biweekly payments, empowering borrowers to make informed decisions. By effectively managing repayment, individuals can leverage the benefits of this alternative financing method while maintaining control over their financial commitments.

- Understanding Car Title Loan Structures

- Advantages of Biweekly Payments

- Effective Management for Borrowers

Understanding Car Title Loan Structures

Car title loans are structured differently from traditional loan options, often featuring biweekly payment schedules. This means borrowers make smaller, more frequent payments instead of one large monthly installment. Such a structure benefits both lenders and borrowers in specific scenarios. Lenders can ensure consistent repayment, while borrowers gain better budget control by spreading out the debt.

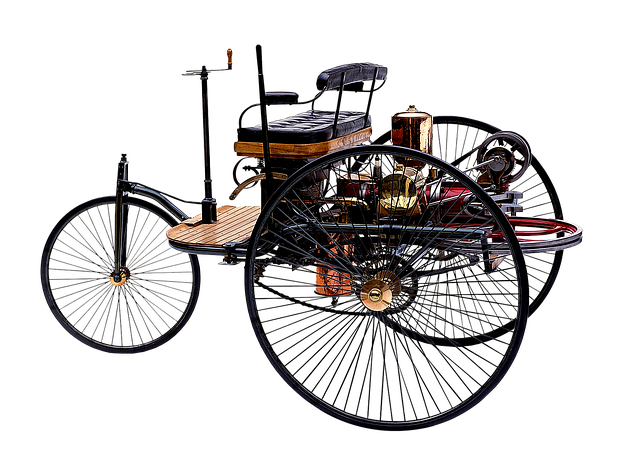

Understanding these loan structures is crucial when considering a car title loan. Unlike fast cash options that may require a thorough credit check, biweekly payments often focus more on the value of the collateral—in this case, the car—rather than the borrower’s financial history. However, if repayment becomes challenging, borrowers might explore loan extensions to maintain manageable biweekly payments without defaulting.

Advantages of Biweekly Payments

Biweekly payments for car title loans offer several advantages that can make the repayment process more manageable for borrowers. This structured approach allows individuals to split their loan repayments into smaller, more frequent installments, reducing the overall financial burden. By making payments every two weeks, borrowers can ensure they consistently stay on top of their obligations without the stress of larger monthly bills.

This timing also aligns well with many borrowers’ pay cycles, making it easier to budget and plan for these expenses. Moreover, biweekly payments can help borrowers avoid potential late fees and penalties associated with missed or delayed payments, common in traditional monthly repayment schedules. This flexibility is particularly beneficial for those with variable income streams, such as gig workers or freelancers, ensuring they can keep their car title loan accounts in good standing throughout fluctuations in earnings.

Effective Management for Borrowers

Effective management of a car title loan payment schedule is paramount for borrowers to maintain financial stability and avoid default. One crucial strategy involves adopting biweekly payments, which offer several advantages. This approach enables borrowers to split their repayments into smaller, manageable installments, making it easier to budget and ensuring consistent progress towards repaying the loan.

By arranging car title loan biweekly payments, borrowers can also benefit from interest accrual at a more gradual pace. Secured loans, such as those backed by vehicle titles, often have variable interest rates that can be reduced with timely repayments. Regular biweekly payments demonstrate responsible borrowing behavior, facilitating better loan approval terms and potentially lowering overall interest costs. Additionally, a thorough vehicle inspection conducted before the loan approval process ensures the collateral’s condition is accurately assessed, further protecting borrowers from unexpected fees related to repairs or maintenance.

Car title loans offer flexible payment options, with biweekly payments proving particularly beneficial. This schedule enables borrowers to manage their repayments effectively while reaping the advantages of faster debt elimination and reduced interest accrual. By understanding car title loan structures and leveraging biweekly payments, individuals can navigate these loans wisely, ensuring a more manageable financial experience.